Our AI-generated summary

Our AI-generated summary

Financial protection against risk has become a critical factor in strengthening the resilience of economies and societies. Yet, the gap between insurable capital and the coverage actually contracted — the protection gap — remains significant and concerning across the globe.

A Global Challenge with Local Implications

According to the Global Federation of Insurance Associations, the global protection gap amounts to approximately$2.8 trillion per year, equivalent to 3% of global GDP. This gap is particularly pronounced in areas of growing exposure and high social impact — pensions, cyber risk, health, and natural disasters — where an estimated 60% of losses between 2011 and 2020 were uninsured.

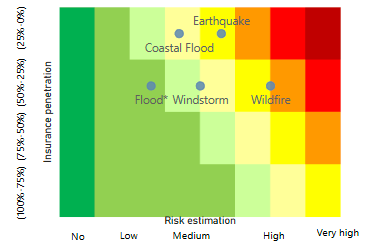

In Portugal, the situation mirrors these global trends. Data from EIOPA (European Insurance and Occupational Pensions Authority) shows that insurance penetration levels for natural risks such as storms, floods, earthquakes, and forest fires remain notoriously low, despite the country’s high exposure of both population and infrastructure to these threats.

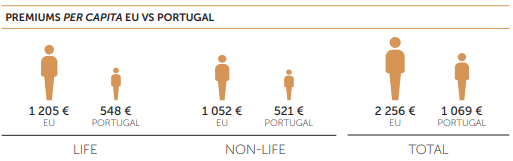

At the same time, the APS (Associação Portuguesa de Seguradores) 2023 report highlights a stark disparity between per capita insurance premiums in Portugal and the European Union average, underscoring the under utilization of available financial protection mechanisms.

This deficit represents a dual reality: on one hand ,a socioeconomic vulnerability for households and businesses; on the other, a strategic opportunity for insurers to innovate and expand their role in protecting society.

A Strategic Role for the Insurance Industry

Closing the protection gap is not solely the responsibility of insurers. it requires coordinated action between industry players, regulators, and governments. However, the insurance sector can take a proactive leadership role by:

- Leveraging advanced analytics and AI to identify underinsured segments, personalize products, and simplify underwriting.

- Promoting financial literacy to increase awareness of risks and the value of insurance.

- Digitizing distribution channels to reduce barriers to contracting and improve accessibility.

These strategies can transform the protection gap from a structural challenge into a driver of sustainable growth.

Our AI-generated summary

Our AI-generated summary